This was originally an answer I posted on Quora in response to the question: What is Birchbox’s Monthly Churn Rate?

I’m estimating that their churn is approximately 8 or 9%. I suspect it started very low (near 5% in 2011/2012) and has slowly ramped up as they have reached serious scale (now, 55 months in to being live). Obviously, this is just an intelligent guess, but I think it makes sense.

With subscriptions at such a low price point, maintaining a churn of < 10% should be relatively doable if the product offering is decent. Theirs is decent. This gels with the churn we’re seeing on Cratejoy subscriptions for beauty products with a low price point. With a churn much higher than that, they would need to add absolutely ridiculous numbers of subscribers per month.

I have a bit of insider information from some fortunate lunches with an early employee that corroborates the < 10% churn as well as some of the COGS assumptions I make below.

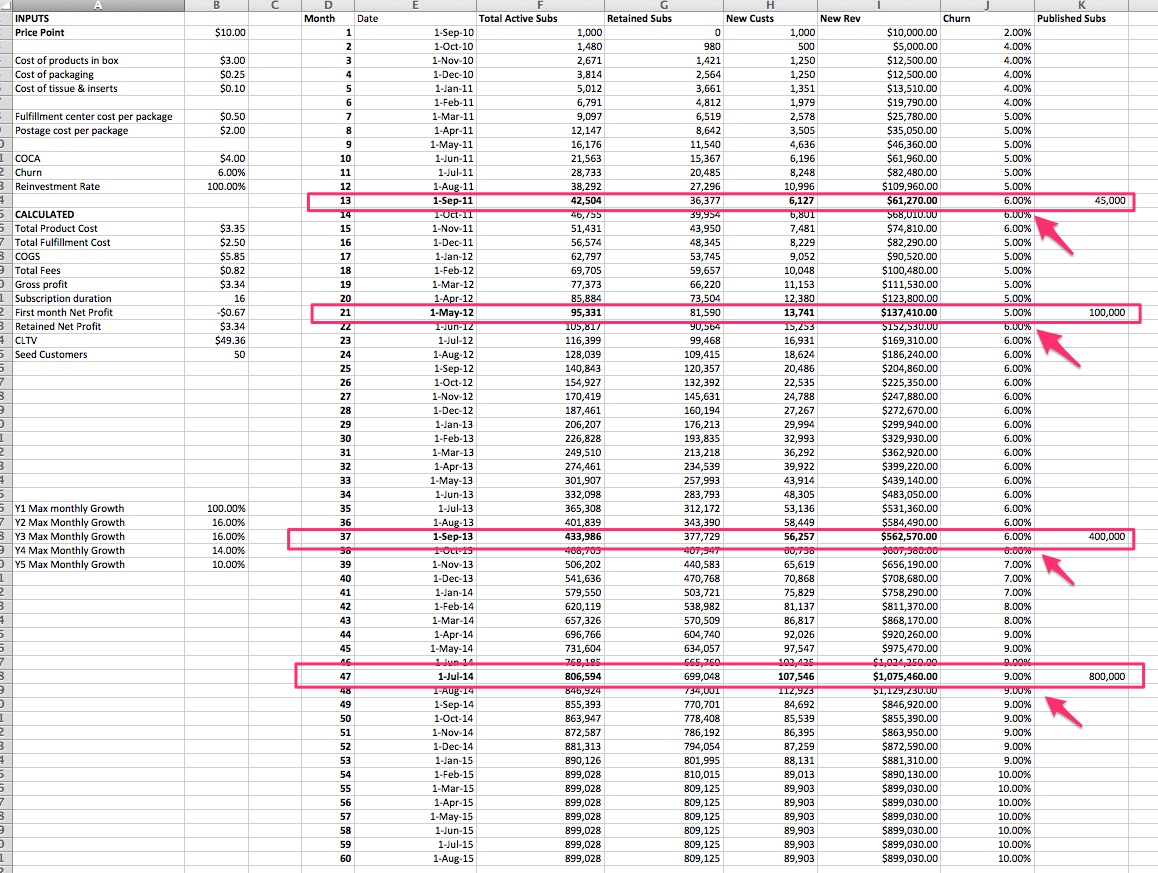

I created the model using a modified version of the output from the subscription box business calculator.

I used the following datapoints for my estimate:

- 45,000 subscribers in September of 2011 (Birchbox secures $10.5M for beauty samples mailing)

- 100,000 subscribers in May of 2012 (Birchbox Co-Founder Katia Beauchamp: We’re Poised To Grow Way Beyond Beauty [TCTV])

- 400,000 subscribers in September of 2013 (With 400,000 subscribers, Birchbox expands from beauty-in-a-box to lifestyle products)

- 800,000 subscribers in July of 2014 (Birchbox, Inc.: Private Company Information)

I also estimated their COGS (cost of goods sold) at $5.85 ($3.35 in product & packaging, $2.50 in shipping & fulfillment).

I built the model by using the subscription box calculator on Cratejoy. I downloaded it to excel and tweaked it from there until it matched the datapoint on subscriber counts and roughly made sense.

Here’s the model for those of you who are interested:

I sell a handcrafted natural, eco beauty box– so this was an interesting read. I have A LOT less subscribers, but I’m working on that. My churn rate is down around 3%. I am wondering, if a higher price point $29 is a factor?