If you’re passionate about a hobby, there’s a good chance you can turn it into a business. Even if you don’t have plans to turn your hobby into a full-time job, the extra income, flexibility, and tax benefits of a side business can be really great.

Subscription boxes are the perfect business model for a lot of hobbyists. Do you like CrossFit, baking, or dogs? All of these pursuits (and a lot more) have been turned into subscription box businesses.

How it Works

Let’s say your hobby is running. Are there snacks you like to take out on the trail? Favorite socks or running gear? Books or other products that runners might enjoy getting each month?

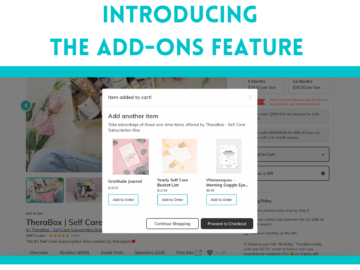

To create a subscription box, you just need to curate a collection of products you think other people would enjoy receiving on a regular basis. Plan to spend some time sourcing products and packing them up for your customers each month. To get customers and manage payments, you can list your subscription box with Cratejoy.

To see an example of a subscription box like this, check out RunLocker. They already took the idea and ran with it (pardon the pun).

Advantages of a Hobby Business

Wholesale Pricing

Once you have a business license, you can reach out to vendors about wholesale pricing for products. All that running gear you love? Now you can share it with your customers and also enjoy the wholesale benefits yourself.

Extra Income

Starting a subscription box isn’t easy money. You’ll need to register your business, source products, answer customer questions and deal with shipping each month. But if you love curating the products and connecting with other enthusiasts around your hobby, it can be a great source of additional income.

For example, Julie Ball runs an all-woman web development and marketing agency. She decided to start a subscription box called Sparkle Hustle Grow, centered around her interest in and passion for female entrepreneurship. That revenue is now a nice augment to her primary salary.

Tax Benefits

Do you participate in activities around your hobby? For example, trips for marathons? If so, these can be counted as business expenses, as long as the main purpose of your trip is to promote your subscription box among other running enthusiasts. The IRS does give scrutiny to hobby-type businesses, however, especially if they consistently operate at a loss. So make sure to follow the guidelines and have good accounting in place.

Flexibility

Subscription box businesses offer a huge amount of flexibility. Although you’ll need to source and ship products each month, you can choose when and where to work on your business. This makes it a perfect business for people who already work out of the home or want an additional side hustle to the regular job.

How to Get Started

Generally, the first step to starting a subscription box business is to create a prototype box and gather feedback. You should also check out all the Cratejoy blog for more subscription business resources.

When you’re ready to list your box, you can sign up with Cratejoy.

Interested in starting the perfect hobby business? Cratejoy can help. Sign up for a free 14 day trial to see how listing your products works.